Love, trust, and scams: How to protect your identity in a digital world

by Kate Hernandez | February 3, 2026 | Threat Lab

Reading Time: 4 mins

February is a time for flowers, meaningful connection, and shared moments, but it’s also prime season for scammers to strike. As people seek relationships online, send gifts, and open up personally, romance scams and identity theft spike around Valentine’s Day.

Scammers know exactly how to exploit trust and vulnerability for financial gain. This year, being cautious isn’t just smart, it’s essential.

Recent data shows romance scams aren’t just emotional heartbreaks , they’re expensive. According to the Federal Trade Commission (FTC), Americans lost more than $823 million to online romance scams in 2024, with tens of thousands of reports tied to these frauds.

Why romance and payment scams work so well

Scammers are experts at blending emotional appeal with pressure tactics. They use:

- Affection and attention to build emotional connection, often before any in-person meetings.

- Crisis scenarios (“I lost my wallet overseas”) to trigger sympathy.

- Urgency (“send this now!”) so victims act without pausing.

- Shared background cues (military service, shared hobbies) to seem authentic.

Emotion clouds judgment. When affection enters the digital space without verification, scammers gain the psychological edge they need, and identities, access, and money follow.

In a recent FBI-shared story, a romance scam victim described how what began as daily messages and emotional support slowly turned into financial manipulation , a reminder that these scams don’t start just with red flags, they start with trust.

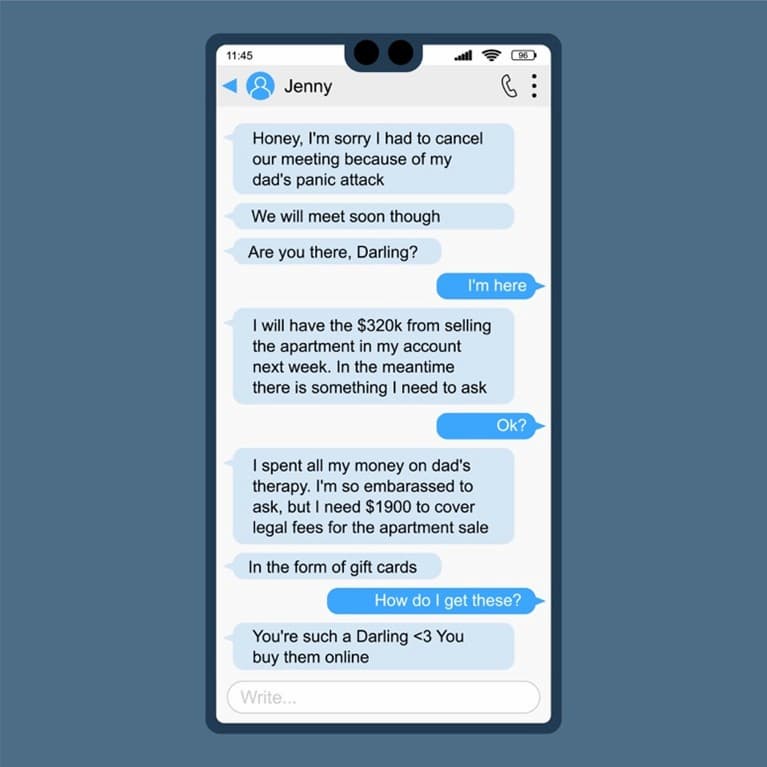

The most common romance and identity scams

Here are scenarios Webroot users might encounter:

- “I lost my wallet overseas”

- Scammer asks you to send money or gift cards to “help.”

- Mystery charges

- You notice unexpected charges after sharing card info.

- Avoids video calls or real meetups

- The person always has an excuse.

- Unverified profiles

- Pictures or bios that look too perfect or pulled from elsewhere.

Each of these isn’t just a red flag — it’s a doorway into deeper identity fraud, account takeover, or financial loss.

Red flags: Would you reply?

- Requests for money, gift cards, or cryptocurrency

- Pressure to keep conversations private

- Emotional manipulation (“you’re the only one I trust”)

- Refusal to video chat or meet in person

- Inconsistent stories or claims that don’t add up

Pause. Verify. Protect. Hesitation isn’t rude, it’s smart.

How identity theft happens behind the scenes

Scammers collect data from your profiles, conversations, and shared documents, then use it to unlock your financial and social accounts. Here are three ways to avoid that from happening.

Step 1: Protect your logins and accounts

Your login credentials are like the keys to your digital heart (and wallet). To protect them:

- Use strong, unique passwords for every account.

- Enable multi-factor authentication (MFA).

- Store passwords securely in a password manager.

Scammers often start by compromising email accounts — from there, they can reset passwords everywhere else.

Step 2: Monitor your identity and financial activity

Early detection makes a huge difference:

- Credit monitoring helps spot unfamiliar inquiries.

- Fraud alerts notify you about suspicious activity.

- Regular reviews of statements and accounts catch abuse early.

Mystery charges or unfamiliar accounts may be your first warning sign — not your last.

Step 3: Verify before you trust

It’s okay, even smart, to be cautious. Good habits include:

- Confirm identities through multiple channels.

- Never send money without verification.

- Don’t rush emotionally charged decisions.

Real relationships don’t hinge on secrecy or financial urgency.

Safeguard your relationships and identity

This Valentine’s Day season, remember that personal connection is precious and so is your identity. Scammers are skilled at mimicking affection, but you can outsmart them with verification, strong security tools, and healthy skepticism.

Protect what matters this Valentine’s Day with Webroot Total Protection, secure your identity, accounts, and peace of mind.

Additional information

Federal Bureau of Investigation – Romance Scams & Online Fraud

What to Know About Romance Scams

Consumer Financial Protection Bureau – Fraud & Scams